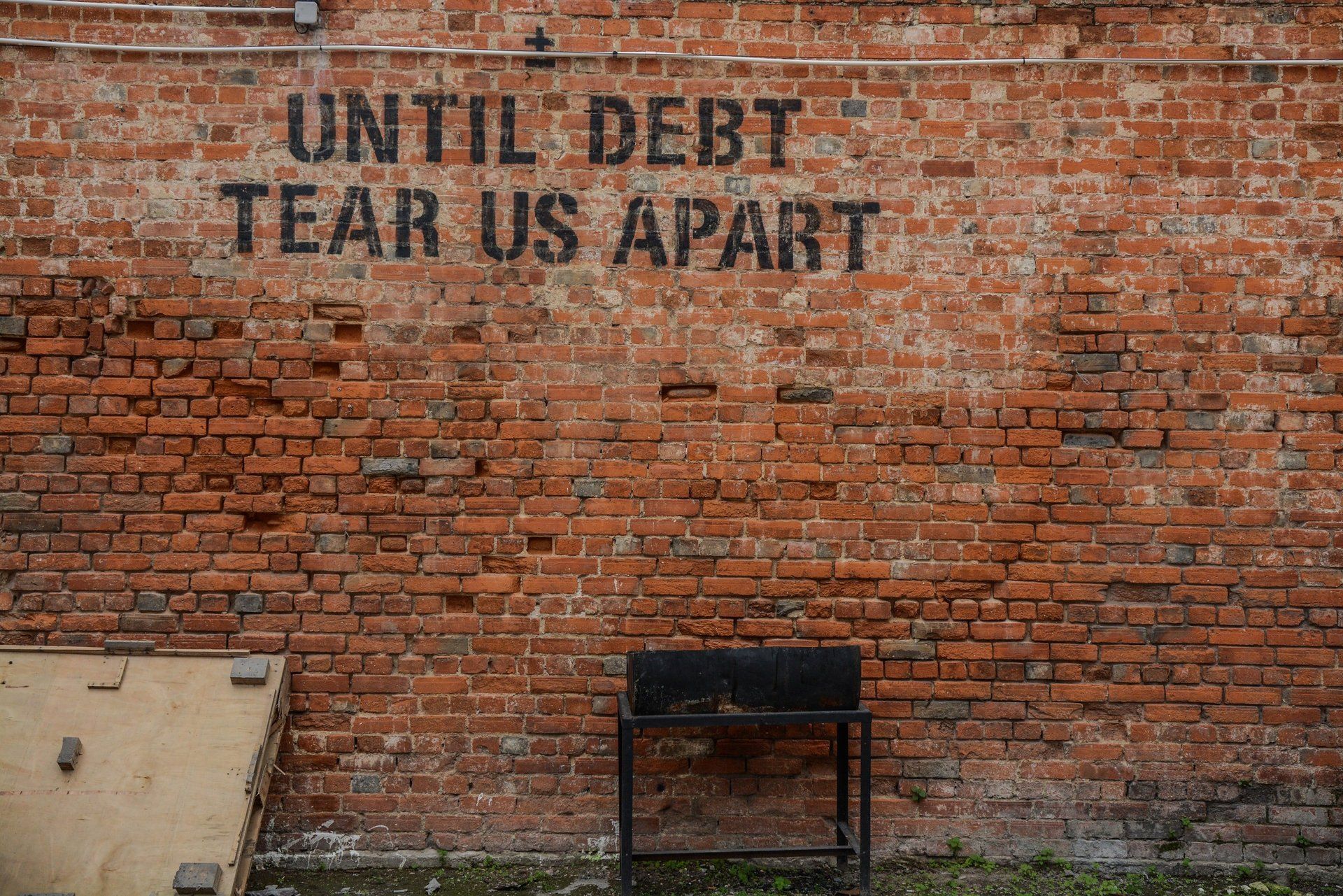

What happens if I can’t pay my mortgage?

Throughout 2023, it’s estimated that 1.8 million fixed-rate mortgage deals will expire1. With mortgage rates at their highest in 15 years2, many of those who remortgage will see their repayments increase sharply.

Understanding your options

You could get in touch with your lender, as they may have options available for homeowners who are struggling.

For example, you might be able to:

- Switch to an interest-only mortgage – instead of a repayment mortgage, where you repay the capital plus interest

- Extend your mortgage term – this will lower your monthly repayments – however, it means you’ll pay more interest overall.

You might also be able to take a payment holiday or reduce the amount you are paying for an agreed period. Before making any decisions, it’s a good idea to speak to us first.

You could also consider reducing subscriptions to services like Netflix, shopping around for better deals on broadband and insurance, and drawing up a budget to see where else you might be able to cut costs.

Here to help

We understand that many homeowners are very worried about rising mortgage rates. We are here to advise you about your options and help you make informed decisions about the future – so please get in touch.

Your home may be repossessed if you do not keep up repayments on your mortgage.

1 UK Finance, 2023

2 Money Facts, 2023

Contact Us for a Quote

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Typically we charge a fee of £399 for arranging a mortgage, however the actual fee will depend on your circumstances

Houchell Mortgages Ltd is an Appointed Representative of Stonebridge Mortgage Solutions Ltd, which is authorised and regulated by the Financial Conduct Authority. Registered Office: C/O MJB Avanti, Office 12, Epsilon House, West Road, Ipswich, Suffolk, IP3 9FJ. Registered Company Number: 10272040. Registered in England & Wales. Company FCA no. 763797

Powered by LocaliQ