Rates and Repayment Lengths Rise

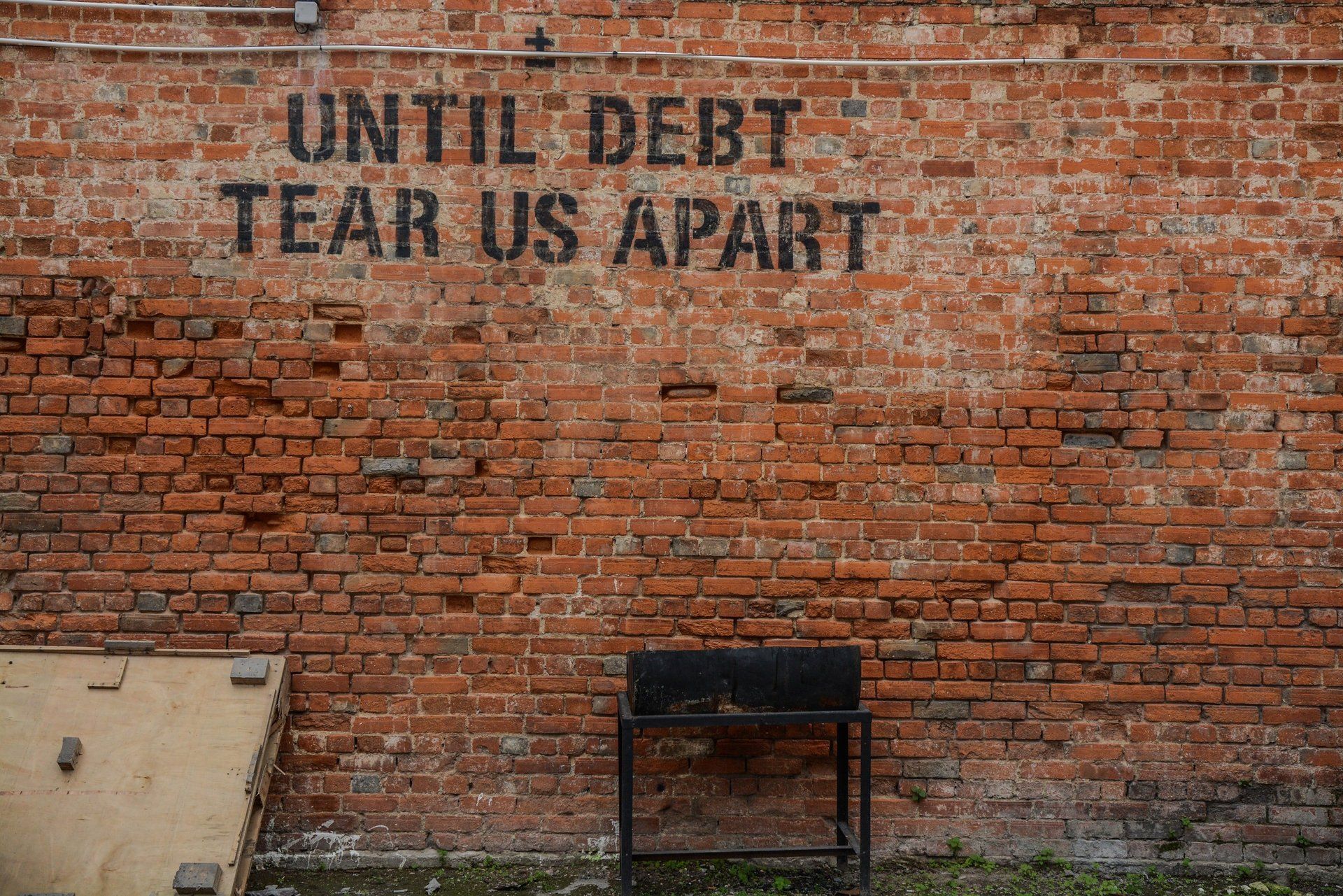

Rising rates again dominated the mortgage market in August, while enduring cost-of-living pressures helped propel longer-term fixes back into the limelight.

Bank rise

More than two million mortgage holders on variable or tracker mortgages are already facing higher repayments after the Bank of England’s Monetary Policy Committee voted to raise its main interest rate by 0.5% at the start of August.

Industry experts now estimate that around 40% of mortgages will go up over the next year, which will force millions into higher monthly payments. Even those currently shielded by a fixed-rate contract aren’t immune; most will end up paying more once their current deal ends.

Indeed, as H2 2021 data show, although 74% of existing mortgage holders are on fixed-rate contracts, half of these will expire in the next 24 months1. Forward planning to find a good deal will become increasingly important if rates keep rising.

Challenges for FTBs (First Time Buyers)

New first-time buyers (FTB) are especially vulnerable, as research revealed they are now spending an average of 40% of their gross salary on mortgage repayments, a level not seen since 2012. The average monthly cost is currently £1,0302, up from £976 before the latest Bank Rate hike.

Despite the negativity surrounding rates, however, the Bank of England does not fear a squeeze on households to such an extent as seen during the financial crisis of 2008.

Longer terms

Elsewhere in the market, the average length of a mortgage loan taken out by FTBs hit 30 years in June3, a record high and nearly five years longer than two decades previously. More than one in three FTBs opted for a mortgage between 30 and 35 years.

This average term could climb yet higher since the government is pondering ultra-long mortgage deals as a possible way to boost homeownership. Long terms help more people achieve their property goals because a longer mortgage period allows larger sums to be borrowed.

Yet calculations4 have shown the staggering sums these mortgages could end up costing. For example, with a 75% loan-to-value mortgage, an average house price and an average long-term fixed rate of 6.19%, monthly repayments would stand at £1,140 – which would mean £472,984 paid in interest alone over a 50-year term!

Back to basics

With cost-of-living pressures at the front of people’s minds, it can be hard to keep a level head when making big financial decisions. Regardless of short-term volatilities, however, the basics of homeownership remain the same.

Getting the right advice is more important than ever – and we’re always here to help. Wherever your property goals take you, we can support you every step of the way.

As a mortgage is secured against your home or property, it could be repossessed if you do not keep up mortgage repayments.

1 Financial Conduct Authority

2 Rightmove

3 UK Finance

4 Barrows and Forrester

Contact Us for a Quote

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Typically we charge a fee of £399 for arranging a mortgage, however the actual fee will depend on your circumstances

Houchell Mortgages Ltd is an Appointed Representative of Stonebridge Mortgage Solutions Ltd, which is authorised and regulated by the Financial Conduct Authority. Registered Office: C/O MJB Avanti, Office 12, Epsilon House, West Road, Ipswich, Suffolk, IP3 9FJ. Registered Company Number: 10272040. Registered in England & Wales. Company FCA no. 763797

Powered by LocaliQ